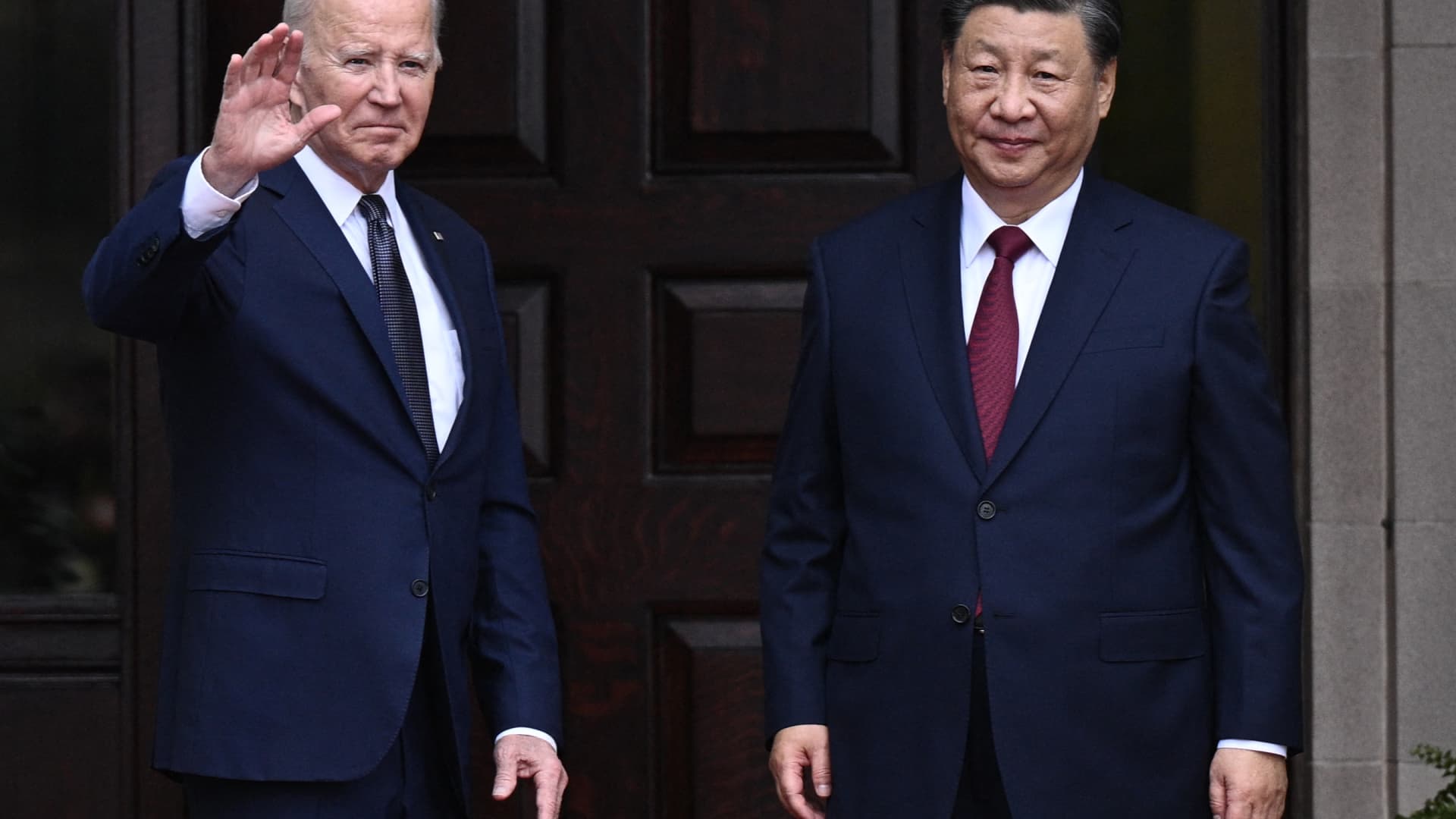

President Joe Biden spoke with Chinese language President Xi Jinping on the telephone Tuesday, a name the White Home described as a manner for the 2 leaders to “examine in” and responsibly handle the strained U.S.-China relationship.

“Intense competitors requires intense diplomacy to handle tensions, tackle misperceptions and forestall unintended battle,” a senior administration official mentioned on a name with reporters on Monday. “This name is a technique to try this.”

Throughout the name with Xi, the primary such telephone assembly since July 2022, Biden raised a number of U.S. considerations, in line with a White Home readout of the decision.

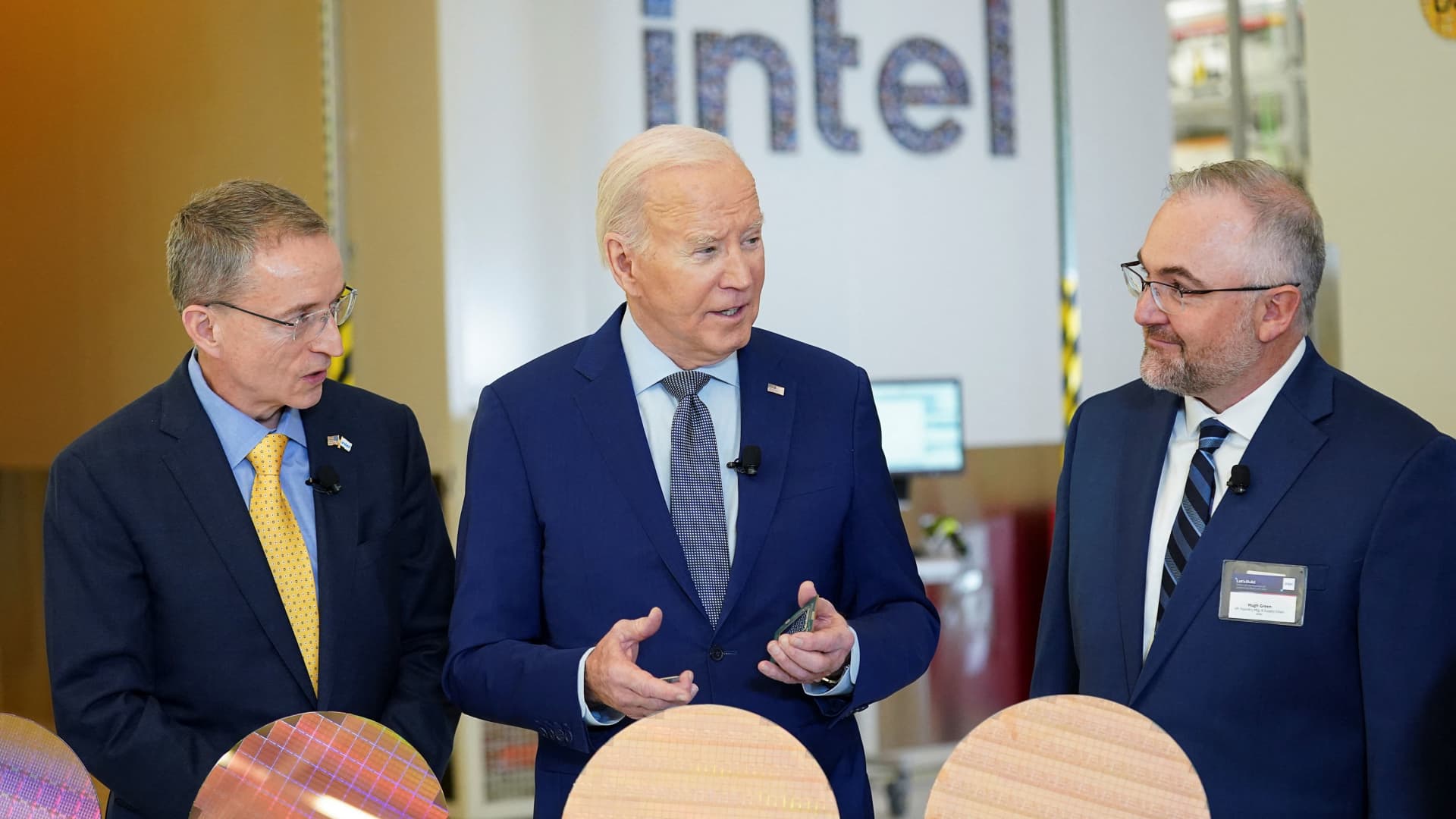

Particularly, Biden confronted Xi on China’s “unfair commerce insurance policies and non-market financial practices,” the White Home mentioned. The president additionally informed Xi that he would proceed to take “crucial actions” to dam China’s entry to U.S. expertise if it poses a nationwide safety threat.

In February, for instance, Biden launched a probe into Chinese language sensible automobiles, prompted by considerations that they may undermine U.S. nationwide safety by connecting to American infrastructure and extracting driver knowledge.

Together with the U.S.-China financial relationship, the 2 leaders mentioned tensions over Taiwan and China’s help for Russia in its Ukraine invasion. Biden additionally raised the prospect of cybersecurity threats, particularly forward of November’s U.S. presidential election.

“We’re being crystal clear about our concern that any nation intrude or affect our elections,” a senior administration official mentioned Monday.

The final time Biden and Xi met in particular person was in November, on the sidelines of a summit in Woodside, California.

There, the leaders agreed to renew military-to-military communications between the U.S. and China. Since then, there have been a number of vital conferences and conversations between army management, with extra anticipated later this 12 months, the Biden administration official mentioned.

On Wednesday, Biden’s prime financial envoy, Treasury Secretary Janet Yellen, is scheduled to depart for China to carry face-to-face conferences together with her counterparts over 5 days in Guangzhou and Beijing. Secretary of State Antony Blinken additionally plans to go to China later this 12 months.

“The U.S.-China financial relationship is definitely now on firmer footing than it was two years in the past,” a senior Treasury official mentioned Monday on a press name to preview Yellen’s journey. “We all know that there are deep challenges and disagreements on this relationship, and that they will not be solved in a single day.”

Final week in a speech, Yellen warned of her considerations about China’s overproduction of unpolluted vitality merchandise like photo voltaic panels, electrical autos and lithium-ion batteries. She mentioned China was utilizing this surplus to flood international markets and undercut pricing in inexperienced industries nonetheless creating in international locations like america.

Yellen mentioned this was one of many points she deliberate to confront her Chinese language counterparts about throughout her go to. The Chinese language embassy in Washington later denied there was any overcapacity.

In current weeks, the Treasury Division has additionally highlighted considerations about Beijing’s monetary practices, particularly China’s alleged use of “early-stage” investments in U.S. tech sector corporations as a solution to entry delicate knowledge.

Conferences like these Yellen plans to carry are a part of the Biden’ administrations’s total effort to stabilize relations between the superpowers after a years lengthy communication freeze. That breakdown started with the Trump-era tariffs that sparked a close to commerce battle, and continued after Biden imposed his personal commerce restrictions on the nation.

“To take it again to that assembly final November, each President Biden and President Xi agreed that they’d attempt to decide up the telephone a bit extra,” the senior administration official mentioned. “Either side understand that it is vital to try this to actually handle relationships in a extra accountable vogue.”