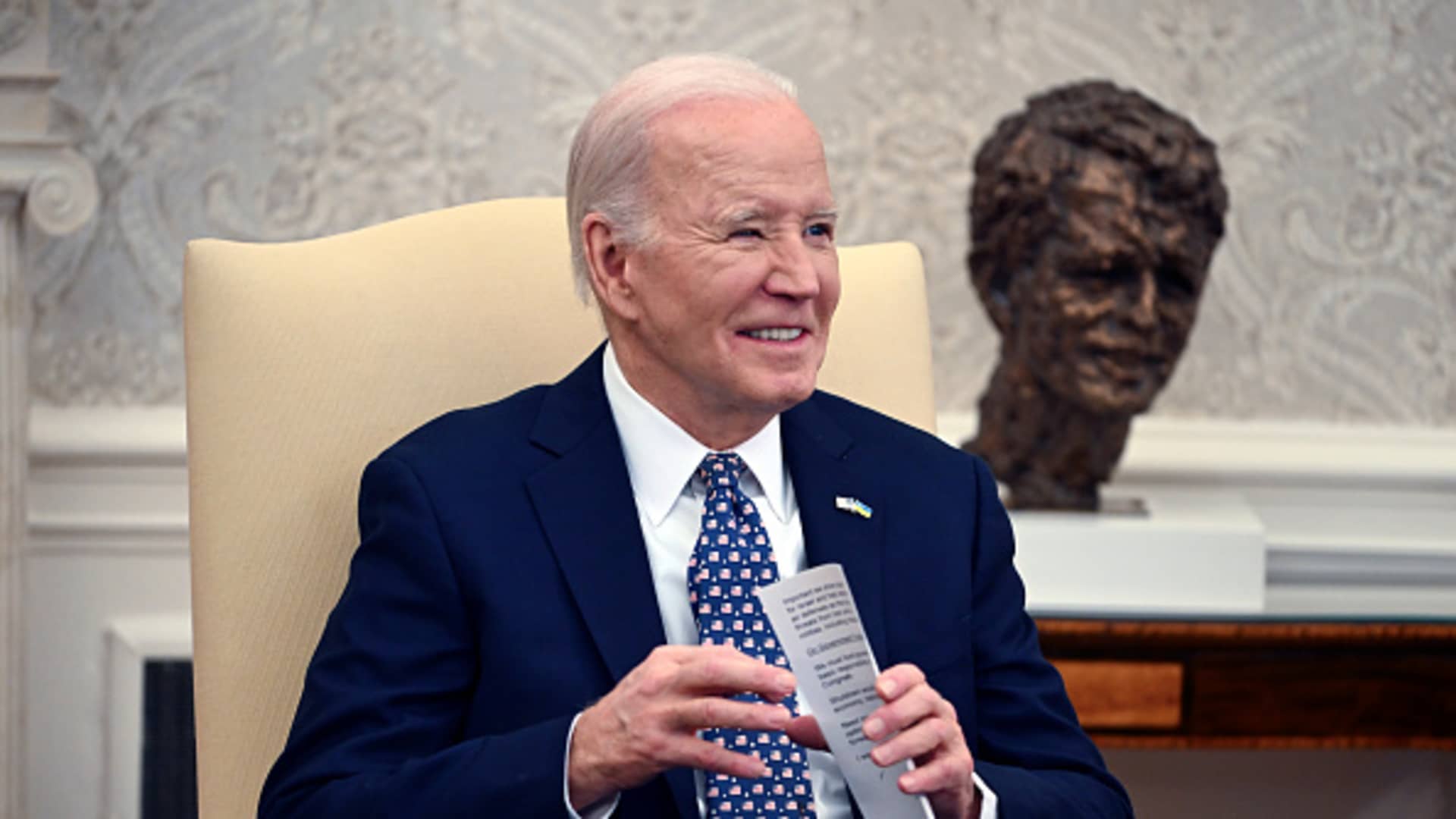

U.S. President Joe Biden and Vice President Kamala Harris meet with (L-R) Senate Minority Chief Mitch McConnell (R-KY), Home Speaker Mike Johnson (R-LA), Senate Majority Chief Chuck Schumer (D-NY), Home Minority Chief Hakeem Jeffries (D-NY), on February 27, 2024 on the White Home in Washington, DC.

Roberto Schmidt | Getty Photos

President Joe Biden on Saturday signed Congress’ $1.2 trillion spending package deal, finalizing the remaining batch of payments in a long-awaited funds to maintain the federal government funded till Oct. 1.

Virtually midway into the fiscal 12 months, the president’s signature ends a months-long saga of Congress struggling to safe a everlasting funds decision and as an alternative passing stopgap measures, practically averting authorities shutdowns.

“The bipartisan funding invoice I simply signed retains the federal government open, invests within the American folks, and strengthens our economic system and nationwide safety,” Biden mentioned in a Saturday assertion. “This settlement represents a compromise, which implies neither facet obtained every part it wished.”

The weekend funds deal slid in just below the wire earlier than the Friday midnight funding deadline, as has been typical this fiscal 12 months with eleventh-hour disagreements derailing near-complete offers.

The Senate handed the funds in a 74-24 vote at roughly 2 a.m. ET Saturday morning, technically two hours after the deadline on account of last-minute disagreements. Nevertheless, the White Home mentioned that it might not start official shutdown operations since a deal had in the end been secured and solely procedural actions remained.

The Home handed its personal vote Friday morning after per week of scrambling to reconcile a lingering sticking level: funding for the Division of Homeland Safety, which the White Home took concern with final weekend. The White Home’s qualms delayed the negotiation course of additional, simply as lawmakers have been making ready to launch the legislative textual content of the funds proposal.

This trillion-dollar tranche of six appropriation payments will fund businesses associated to protection, monetary providers, homeland safety, well being and human providers and extra. Congress accredited $459 billion for the primary six appropriations payments earlier in March, which associated to businesses that have been much less partisan and simpler to barter.

With the federal government lastly funded for the remainder of the fiscal 12 months, Home Speaker Mike Johnson, R-La., has cleared his plate of not less than one looming concern.

However in so doing, he might have created one other.

Hours earlier than the Home handed the spending package deal Friday morning, hardline Home Republicans held a press convention to lambast the invoice. Moments after the Home narrowly handed the invoice, far-right Georgia Republican Rep. Marjorie Taylor Greene filed a movement to oust Johnson.

If ousting a Home speaker for funds disagreements looks like a well-recognized story, that is as a result of it’s.

In October, after former Speaker Kevin McCarthy struck a take care of Democrats to avert a authorities shutdown, the Home voted to take away him, making him the primary Speaker in historical past to be faraway from that place. Johnson has been making an attempt to appease the hardline Republican wing of the Home, known as the Freedom Caucus, to keep away from assembly the same destiny.