Sergio Ermotti, CEO of Swiss banking big UBS, throughout the group’s annual shareholders assembly in Zurich on Might 2, 2013.

Fabrice Coffrini | Afp | Getty Photographs

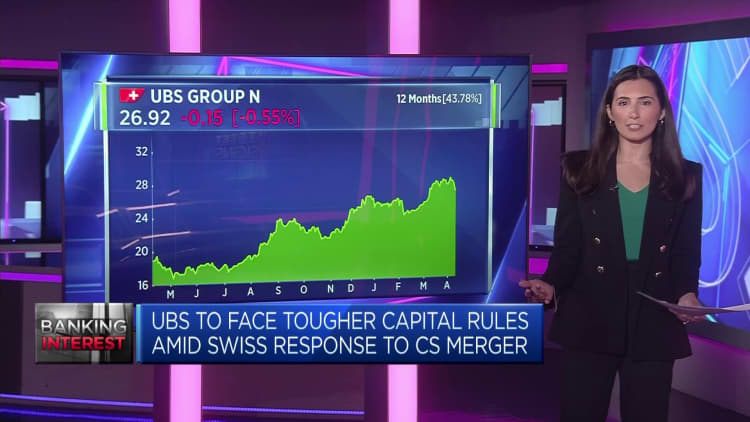

Switzerland’s robust new banking laws create a “lose-lose scenario” for UBS and will restrict its potential to problem Wall Road giants, in line with Beat Wittmann, associate at Zurich-based Porta Advisors.

In a 209-page plan printed Wednesday, the Swiss authorities proposed 22 measures aimed toward tightening its policing of banks deemed “too huge to fail,” a yr after authorities have been pressured to dealer the emergency rescue of Credit score Suisse by UBS.

The federal government-backed takeover was the largest merger of two systemically necessary banks because the World Monetary Disaster.

At $1.7 trillion, the UBS steadiness sheet is now double the nation’s annual GDP, prompting enhanced scrutiny of the protections surrounding the Swiss banking sector and the broader economic system within the wake of the Credit score Suisse collapse.

Chatting with CNBC’s “Squawk Field Europe” on Thursday, Wittmann stated that the autumn of Credit score Suisse was “a wholly self-inflicted and predictable failure of presidency coverage, central financial institution, regulator, and above all [of the] finance minister.”

“Then after all Credit score Suisse had a failed, unsustainable enterprise mannequin and an incompetent management, and it was all indicated by an ever-falling share value and by the credit score spreads all through [20]22, [which was] fully ignored as a result of there isn’t a institutionalized know-how on the policymaker ranges, actually, to observe capital markets, which is crucial within the case of the banking sector,” he added.

The Wednesday report floated giving extra powers to the Swiss Monetary Market Supervisory Authority, making use of capital surcharges and fortifying the monetary place of subsidiaries — however stopped wanting recommending a “blanket enhance” in capital necessities.

Wittman prompt the report does nothing to assuage issues concerning the potential of politicians and regulators to supervise banks whereas guaranteeing their world competitiveness, saying it “creates a lose-lose scenario for Switzerland as a monetary heart and for UBS not to have the ability to develop its potential.”

He argued that regulatory reform ought to be prioritized over tightening the screws on the nation’s largest banks, if UBS is to capitalize on its newfound scale and at last problem the likes of Goldman Sachs, JPMorgan, Citigroup and Morgan Stanley — which have equally sized steadiness sheets, however commerce at s a lot greater valuation.

“It comes all the way down to the regulatory degree enjoying discipline. It is about competences after all after which concerning the incentives and the regulatory framework, and the regulatory framework like capital necessities is a worldwide degree train,” Wittmann stated.

“It can’t be that Switzerland or some other jurisdiction is imposing very, very completely different guidelines and ranges there — that does not make any sense, then you definitely can not actually compete.”

To ensure that UBS to optimize its potential, Wittmann argued that the Swiss regulatory regime ought to come into line with that in Frankfurt, London and New York, however stated that the Wednesday report confirmed “no will to interact in any related reforms” that will shield the Swiss economic system and taxpayers, however allow UBS to “catch as much as world gamers and U.S. valuations.”

“The observe document of the policymakers in Switzerland is that we had three world systemically related banks, and we now have now one left, and these circumstances have been the direct results of inadequate regulation and the enforcement of the regulation,” he stated.

“FINMA had all of the authorized backdrop, the devices in place to handle the scenario however they did not apply it — that is the purpose — and now we discuss fines, and that appears like pennywise and pound silly to me.”