Michael Sonnenfeldt, Tiger 21

Scott Mlyn | CNBC

Non-public fairness is at the moment “king” amongst members of Tiger 21 — a community of ultra-high internet value entrepreneurs and traders — in accordance with its founder and chairman, Michael Sonnenfeldt.

The non-public fairness business had an particularly powerful 2022 after a decade-long bull run, however has picked up to date this 12 months.

Sonnenfeldt advised CNBC on Friday that Tiger 21 members, who collectively handle round $150 billion in property, have elevated their allocation to personal fairness threefold during the last decade, and see additional alternatives amid an anticipated increase for corporations uncovered to AI and local weather.

Most Tiger 21 members are entrepreneurs who’ve offered their corporations and are actually within the enterprise of wealth preservation.

“Money holdings are round 12%, they’ve trimmed down public equities, however our actual property got here down a 12 months or two in the past due to rising rates of interest, and personal fairness is now king — that is the place companies are nonetheless scaling,” Sonnenfeldt mentioned.

“After all, the provision of credit score makes it a little bit tougher, however non-public fairness is the place our members are actually centered as a result of when you’ve got fundamental companies which are rising quickly, that may outperform the market.”

Non-public fairness has grown as a share of members’ portfolios from 10% to 30% during the last decade, Sonnenfeldt revealed, with enterprise capital comprising a bigger portion than ever earlier than.

“Quite a lot of our members have seen that AI is a large alternative, local weather is a large alternative and clearly the power markets have completed nicely, so our members actually assume that the basic progress over the long run goes to be favored,” he added.

In accordance with a quarterly report from EY, non-public fairness exercise climbed 15% within the second quarter of 2023 versus the primary, with complete deal values hitting $114 billion on the again of a steep rise in Europe.

However not everyone seems to be satisfied that the optimism is justified. Dan Rasmussen, founder and chief funding officer at hedge fund Verdad Advisers, advised CNBC on Friday that the business is going through a “good storm” within the wake of sharp rises in rates of interest and falling tech valuations.

“There are three massive issues going through non-public fairness. The primary is that the majority of personal fairness is leveraged — about 60% internet debt to enterprise worth for the common buyout — and nearly all of that debt is floating fee,” he mentioned.

As rates of interest have risen dramatically, the common curiosity prices for personal fairness corporations have spiked. The median curiosity prices as a share of EBITDA (earnings earlier than curiosity, tax, depreciation and amortization) within the non-public fairness and enterprise capital business was 43% in 2022, whereas the median throughout corporations on the S&P 500 index was 7%, in accordance with Verdad Advisers.

“The second drawback is non-public fairness is 40%-plus uncovered to the expertise sector, expertise valuations have been falling, and in order you see multiples coming down, that is creating an extra drawback,” Rasmussen mentioned.

Cumulatively, this implies the non-public fairness business has been shopping for corporations at premium valuations versus public markets, with increased ranges of debt.

Although some massive tech corporations with important publicity to AI have seen valuations soar this 12 months, dragging up the averages for the broader sector, smaller corporations with increased leverage have usually not seen the identical boon.

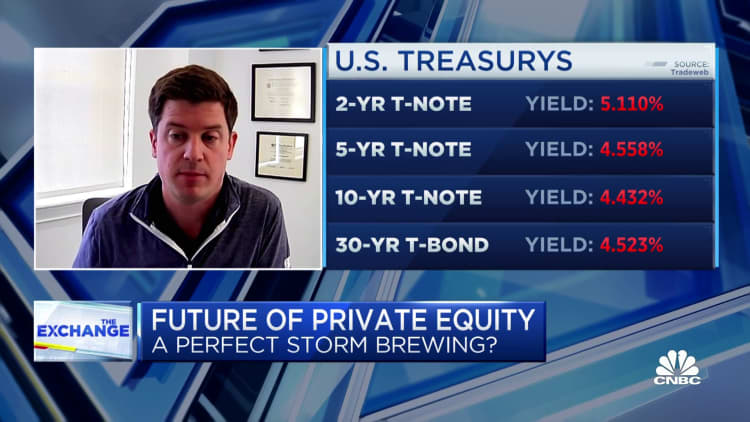

The U.S. Federal Reserve has elevated rates of interest by greater than 500 foundation factors over the previous 18 months, from a goal vary of 0.25-0.5% in March 2022 to five.25-5.5% in July.

Although the Federal Open Market Committee opted this month to pause its fee climbing cycle, the central financial institution has urged charges will keep increased for longer, which is often damaging for extremely leveraged parts of the market focusing on speedy progress.

“From a quantitative perspective, the basics of sponsor-backed corporations look scary,” Rasmussen mentioned in a analysis word earlier this 12 months.

“But non-public fairness stays the darling asset class of subtle traders, with many endowments and household places of work nearing a 40% allocation. The monetary fundamentals look far much less enticing than one would possibly anticipate, given such excessive stage of enthusiasm.”