Jonathan Raa | Nurphoto | Getty Photographs

Trump Media has warned the CEO of the Nasdaq Inventory Market of ‘potential market manipulation’ of the corporate’s inventory by “bare” quick promoting of shares.

The warning got here as Trump Media has provided shareholders detailed directions on how one can keep away from somebody loaning out their DJT shares to quick sellers, who then execute trades betting that the worth of the inventory will fall.

Trump Media disclosed the warning to Nasdaq CEO Adena Friedman in a submitting Friday morning with the Securities and Change Fee.

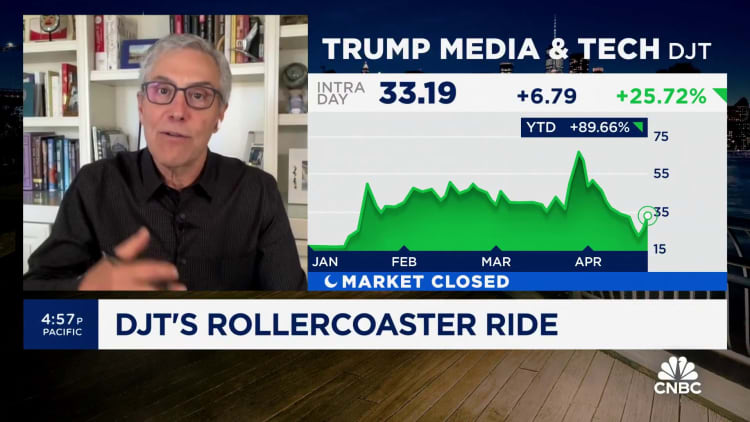

DJT’s share value has rallied in current days, however remains to be sharply decrease than the greater than $70 per share it debuted with on March 26. Former President Donald Trump owns practically 60% of Trump Media shares. The paper worth of his stake has dropped by billions of {dollars} since DJT started public buying and selling final month.

Trump Media CEO Devin Nunes in his letter to Friedman didn’t immediately accuse anybody particularly of bare quick promoting, which is the sale of shares with out first having borrowed such gross sales for that objective.

However Nunes famous that as of Wednesday “DJT seems on Nasdaq’s ‘Reg SHO threshold listing,’ which is indicative of illegal buying and selling exercise.”

“That is notably troubling on condition that ‘bare’ quick promoting typically entails subtle market contributors profiting on the expense of retail buyers,” Nunes stated.

Nevertheless, the SEC on its web site notes {that a} failure to ship shares as a part of a brief sale commerce, which may land an organization on the Reg SHO threshold listing, doesn’t essentially replicate improper buying and selling exercise like bare quick promoting.

“There are a lot of justifiable explanation why broker-dealers don’t or can’t ship securities on the settlement date,” the SEC notes in a piece about Regulation SHO.

However in his letter, Nunes, whose firm owns the Fact Social app, pointed to circumstantial proof, which included DJT being in early April the most costly inventory to quick in the US, which he stated would give brokers “important monetary incentive to lend non-existent shares.”

The letter hyperlinks to a CNBC article detailing the sky-high premiums brokers have been charging quick sellers for loans of DJT shares to promote.

“I write to deliver your consideration to potential market manipulation of the inventory of Trump Media & Know-how Group Corp.” Nunes wrote.

“As , ‘bare’ quick promoting — promoting shares of a inventory with out first borrowing the shares of inventory deemed troublesome to find — is mostly unlawful pursuant to Securities and Change Fee (‘SEC’) Regulation SHO,” he wrote.

“Knowledge made obtainable to us point out that simply 4 market contributors have been liable for over 60% of the extraordinary quantity of DJT shares traded: Citadel Securities, VIRTU Americas, G1 Execution Companies, and Jane Road Capital,” Nunes wrote.

DJT value for previous month

“In gentle of the foregoing, and Nasdaq’s obligation and dedication to guard the pursuits of retail buyers, please advise what steps you’ll be able to take to foster transparency and compliance by making certain market makers are adhering to Reg SHO, requiring brokers to reveal their ‘Web Brief” positions, and stopping the lending of shares that don’t exist,” Nunes wrote.

“TMTG seems to be ahead to helping your efforts.”

A Nasdaq spokesperson advised CNBC, “Nasdaq is dedicated to the ideas of liquidity, transparency, and integrity in all our markets.”

“We have now lengthy been an advocate of transparency briefly promoting and have been an lively supporter of the SEC’s guidelines and enforcement efforts designed to watch and prohibit bare quick promoting,” the spokesperson stated.

A spokesperson for Citadel Securities advised CNBC, “Devin Nunes is the proverbial loser who tries in charge ‘bare quick promoting’ for his falling inventory value.”

“Nunes is precisely the kind of particular person Donald Trump would have fired on ‘The Apprentice,’ ” the spokesperson stated, referring to Trump’s former actuality enterprise competitors present.

“If he labored for Citadel Securities, we might hearth him, as capability and integrity are on the middle of every part we do,” the spokesperson stated.

A spokeswoman for Trump Media in response to that stated, “Citadel Securities, a company behemoth that has been fined and censured for an extremely wide selection of offenses together with points associated to bare quick promoting, and is world well-known for screwing over on a regular basis retail buyers on the behest of different companies, is the final firm on earth that ought to lecture anybody on ‘integrity.’ “

A spokesman for Virtu Monetary, the guardian firm of Virtu Americas, declined to remark.

G1 Execution Companies, and Jane Road Capital had no fast touch upon Nunes’ letter,

Knowledge from Factset exhibits that the quick quantity in DJT shares has not considerably modified since April 7, whereas the inventory value has sharply dropped earlier than seeing a pointed bounce in current days.

Brief quantity is the variety of tradable shares being bought quick throughout a particular interval.

The info means that there was no change within the sample of quick promoting that affected DJT’s value throughout that very same time.

Trump, the presumptive Republican presidential nominee, at the moment is on trial in New York state court docket on felony costs associated to a 2016 hush cash fee by his then-lawyer to the porn actor Stormy Daniels.

Correction: This text has been up to date to appropriate the spelling of Adena Friedman’s title.